Lunasa Ltd produces waste recycling machinery and is currently planning to bring a new machine to the market: Corporate Finance Assignment, ICD, Ireland

| University | Independent Colleges Dublin (ICD) |

| Subject | Corporate Finance |

Question 1

Lunasa Ltd produces waste recycling machinery and is currently planning to bring a new machine to the market. It expects each proposed product will have an expected life of six years. Funding constraints mean that it may only launch one of the products in the current investment cycle.

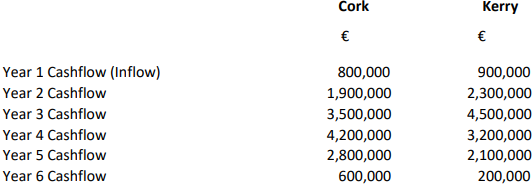

Product Cork would require an immediate investment of €10.4m. Product Kerry would require an immediate investment of €10.1m.

The Finance department has reliably calculated the Cost of Capital at 9%, and have forecasted future cash flows for each product as follows:

At the end of the year, 6 Plant & Equipment used in each project is expected to have a scrap value of €1,800,000 which has been excluded from each set of cashflows above.

- Evaluate each Product using the following:

(i) The Payback Method

(ii) Net Present Value

(iii) Internal Rate of Return - Outline which product if any should be introduced by Lunasa Ltd. In your answer, provide reasons for your choice.

- Discuss three options that Lunasa Ltd could use to raise the money required for this investment.

- Draft a note to the Managing Director of Lunasa Ltd that explains the advantages and disadvantages of using the Payback method and Net Present Value to evaluate projects.

Question 2

- Athlone Ltd is a wholesaler of animal feeds that supplies around 60 retailers. The company has annual sales of €68,000,000.

Customers are offered standard terms of 30 days credit. The current balance on receivables is €14,200,000. The receivable days are 76 days, which is a matter of concern for the managing director of Athlone Ltd. In the previous year receivable days were 62 days.

The Management of Athlone Ltd is considering offering a discount of 1% to customers if they pay in full within 21 days.

The company’s receivables are currently financed by a Bank loan at 11.25%.

(i) Calculate the effective annualized cost of offering the discount, showing your workings.

(ii) Advise Athlone Ltd if it should issue the discount for prompt payment within 21 days, or if it should continue to use the Bank overdraft and accept the higher receivable

days. - The managing director of Athlone Ltd has asked you about the advantages and disadvantages of early settlement discounts. Write a note to the managing director explaining what value these discounts could have for the company.

- Describe how a wholesaler like Athlone Ltd would research the creditworthiness of its retail customers.

- Briefly explain what is meant by Corporate Social Responsibility (CSR). In your answer, refer to some recent examples of CSR in the supermarket retail business.

Question 3

- Explain the role that Corporate Governance plays in today’s business environment. Discuss, using one example of strong governance and one example of poor governance, some of the key benefits of developing a strong Corporate Governance framework.

- Briefly explain the goals of four different stakeholders in a Corporate Organisation. Considering the setting of pay levels in an organization, how might the goals of different stakeholders vary, and how might differences be resolved?

- Explain briefly, the difference between real interest rates and nominal interest rates. How will a potential investor consider this factor in their decision-making?

- Liquidity is important to a firm because:

(i) It is a measure of Shareholder Value

(ii) It is important to monitor the firm’s ability to pay debts

(iii) It is important to monitor the firm’s Non-Current Asset valuations annually

(iv) It is important that Suppliers offer bulk discounts

(v) It is an important measure of the profitability levels reported to taxation authorities

(vi) It is important to monitor the Cost of Sales.

Question 4

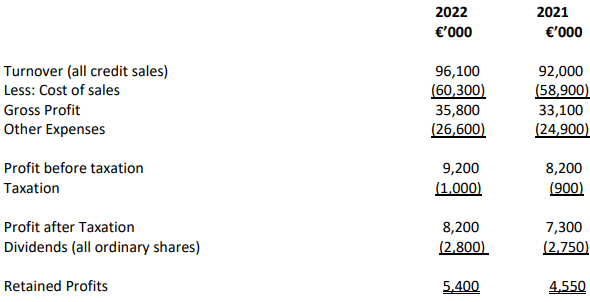

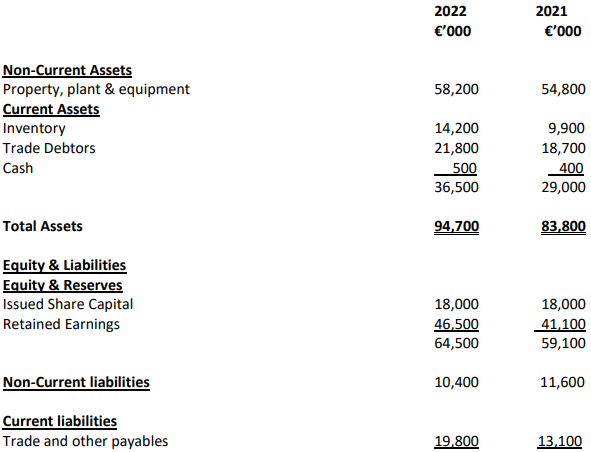

The following information has been extracted from the annual accounts of Vardy Ltd.

Income Statement for the year ending 31st July 2022

Statement of Financial Position as of 31st July 2022

Total equity & liabilities 94,700 83,800

- Calculate the following profitability, liquidity, and activity ratios for each of the two years to 31st July 2021 and 2022, respectively.

(i) Net Profit Ratio

(ii) Return on Capital Employed

(iii) Acid Test Ratio

(iv) Inventory (stock) days

(v) Payable (creditor) days

(vi) Receivable (debtor) days - Comment in detail on the company’s performance for the year ended 31st July 2022, using the above ratios in your answer. Include in your answer, any concerns that stakeholders may have with the performance of this firm.

- Advise Vardy Ltd how it could consider managing its working capital during this trading period. Your answer should refer to this specific company.

If you're looking for a convenient and reliable way to get assignments done, look no further than Irelandassignments.ie! Our online platform offers a wide range of assignment writing services that are designed to help you achieve academic success. So why wait? Visit Irelandassignments.ie today and see how easy it is to buy assignments online!